Press Release

UniCredit Bank Romania, acting as the sole Coordinator and joint Arranger together with Alpha Bank Greece, has structured a €150 million syndicated loan for Prime Kapital

UniCredit Bank Romania, as coordinator of the transaction and in partnership with Alpha Bank Greece have successfully completed the structuring of a syndicated loan of EUR 150 million to refinance Mall Moldova. Owned and developed by Prime Kapital, Mall Moldova was opened in April 2025 and is one of the only two super-regional shopping malls in Romania.

In this transaction, UniCredit Bank contributes EUR 75 million, reaffirming its sector leading role and its commitment to supporting projects with solid economic fundamentals, sustainable performance and healthy long-term growth potential.

“The coordination of this syndicated financing reconfirms our expertise in structuring complex transactions, adapted to current market realities. UniCredit Bank’s participation in the 150-million-euro syndicate reflects its strong commitment to the real estate sector, its leading position and its capacity to support large-scale real estate projects. Our solid partnership with Prime Kapital demonstrates mutual trust, a common long-term vision and a shared interest in projects with significant economic impact”, said Andrei Bratu, Executive Vice President of the Corporate & Investment Banking Division of UniCredit Bank.

“This transaction marks an important milestone and highlights Alpha Bank’s ability to support ambitious investment initiatives with well‑structured and forward‑looking financing solutions. By arranging and participating with €75 million in the €150 million syndicate, we reaffirm our strategic focus on the real estate sector and our commitment to backing projects that promote sustainable development and long‑term value creation. Our relationship with Prime Kapital reflects a strong alignment of objectives and a shared belief in the potential of high‑impact projects that accelerate investment activity and growth,” said Nikolaos Nezeritis, Chief of Corporate and Institutional Banking of Alpha Bank Greece.

“The facility reflects the strong fundamentals of Mall Moldova, which has redefined the shopping and entertainment landscape in eastern Romania since opening in April 2025“, added Andrew Bird, partner at Prime Kapital. “We’re highly appreciative of the efforts of the banks and advisors, which allowed us to close the facility well ahead of our timing requirements“.

About UniCredit Bank

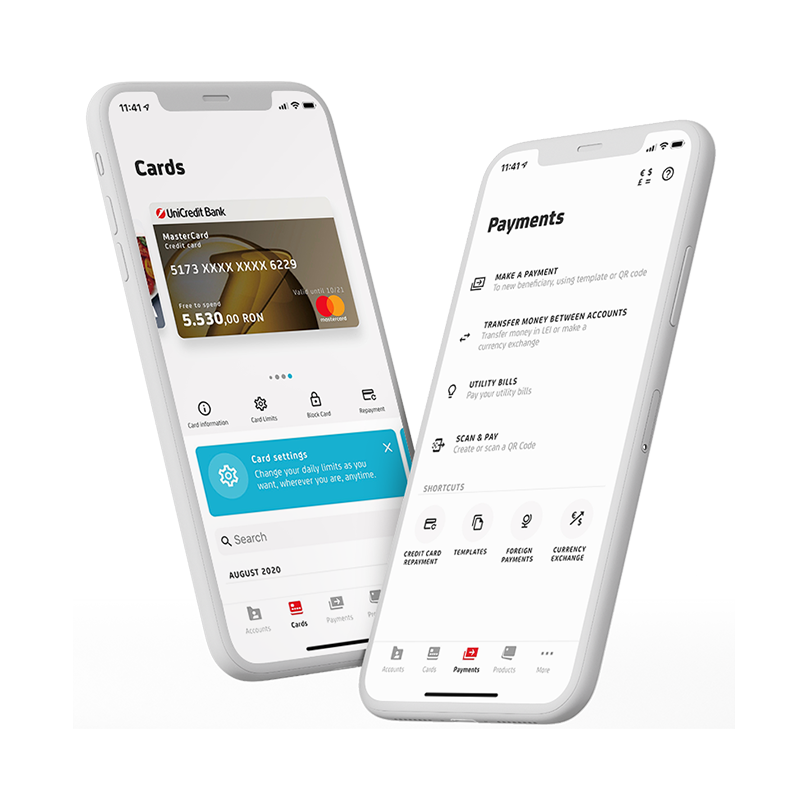

UniCredit Bank is part of the UniCredit Group, a Pan-European Commercial Bank with a unique service offering in Italy, Germany, Austria, Central and Eastern Europe. In Romania, UniCredit Bank is a leading universal bank, offering high-quality services and products for all service categories. UniCredit Bank aims to keep the customer at the center of its activities, to be a partner that is easy to work with and to be an active part of the communities in which it operates. Digitalization and commitment to the ESG principle are key factors for our services and help us offer excellence to all stakeholders for a sustainable future.

About Alpha Bank Greece

Founded in 1879, Alpha Bank is Greece’s oldest privately owned financial institution and one of the country’s largest banking groups. With operations in Greece, Cyprus, Luxembourg and the United Kingdom, the Bank provides a comprehensive suite of products and services to individuals and businesses. Alpha Bank combines strong financial expertise across sectors with investments in human capital and digital innovation with the aim to deliver personalized and market-leading financial solutions. Guided by its purpose to enable progress in life and business for a better tomorrow, the Bank is committed to advancing a sustainable, resilient and inclusive growth model for the Greek economy.

About Prime Kapital

Prime Kapital is a European real estate focused asset manager and developer, with a consolidated asset base of over EUR 1.9 billion and an excellent reputation and track record in the market. It has directly owned real estate assets of over EUR 650 million, including over EUR500m of recently-opened modern malls in Romania which have been developed by Prime Kapital’s vertically integrated team. Prime Kapital is also the largest shareholder of MAS P.L.C., which is listed on the Johannesburg Stock Exchange and owns and operates high-quality, income-generating retail assets of over €1bn across CEE, complemented by a significant minority investment in a joint venture with Prime Kapital.

18.02.2026 - 15:30